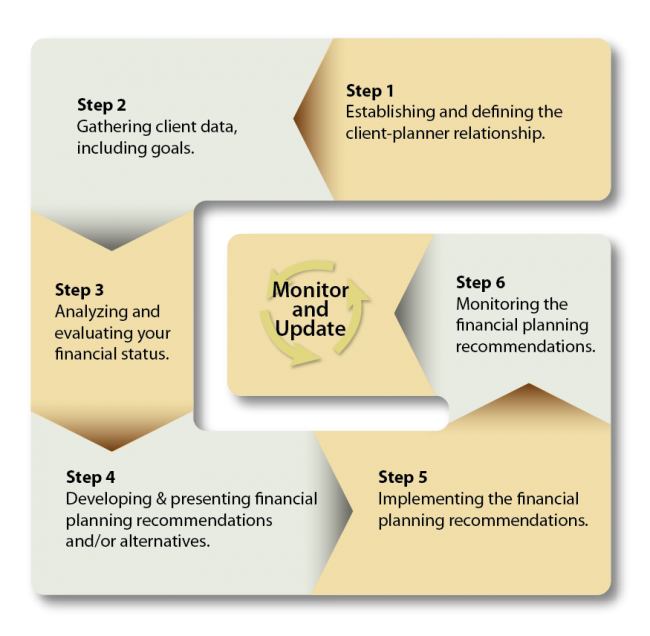

Guidepost Financial Planning utilizes a simple, yet powerful, 6-step Financial Planning Process. We tailor this process to meet each client’s objectives.

We have found that some combination of the following financial planning services meets the objectives of most clients:

Financial Planning

We focus on your goals and work with all the areas of your financial life: tax planning, savings and investment strategies, insurance, estate planning, retirement planning, budgeting and more to create a financial plan that changes as your circumstance change. Instead of just telling you what to do, we work together with you, providing you with easy-to-understand recommendations and we help you implement them every step of the way.

Retirement Planning

The concept of retirement planning is pretty straightforward: generate sufficient income to support your desired lifestyle. It’s implementing a plan to achieve this goal that gets tricky. Some of the many questions that we can help you answer include:

- How much money do you need to accumulate before retirement?

- What kinds of investments will protect principal and offset inflation?

- What role does Social Security play?

- What is the most tax-efficient way to convert investments into an income stream?

Project-based Planning

Guidepost Financial Planning believes in helping people understand and make smart decisions about their finances. We recognize that each client is unique so we serve our clients with flexibility. Sometimes that means a brief financial checkup or maybe it’s a thorough review of your finances. Either way, we can provide guidance or become a longer-term partner with you.At Guidepost Financial Planning we believe that every person deserves competent, objective financial advice at a fair price. We provide advice that is customized to compliment your budget by providing both hourly as-needed and hands-on management services.

Investment Management

At Guidepost Financial Planning we believe investment portfolios should suit your needs. Before we design a custom allocation for you, we work to understand your needs. Only then are we able to create an investment plan which is tailored to you.Ultimately, the success of your portfolio is measured by whether or not it helps you accomplish your objectives. Investing can be overwhelming, but you don’t have to go it alone. We can help you stay on track and focused on your long-term goals.